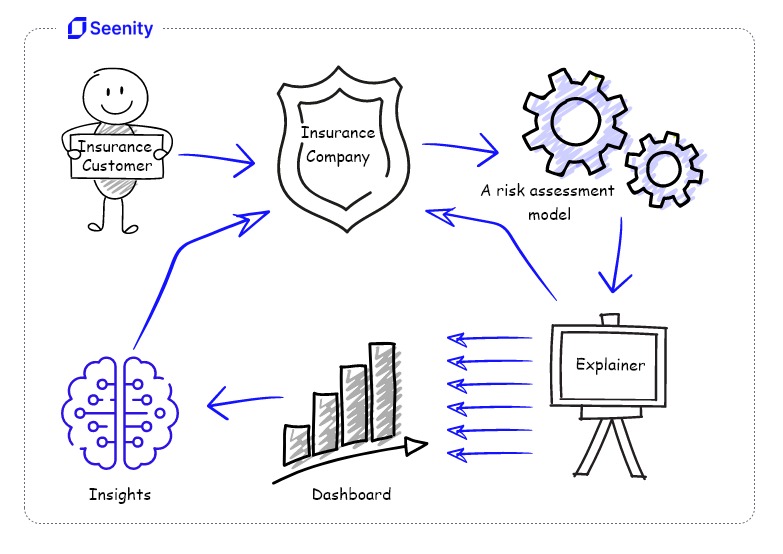

Critics argue that artificial intelligence models are akin to black boxes, impeding the assessment of risk without insight into decision-making processes. In the realms of insurance and loans, this critique gains validity due to the multifaceted nature of risk, comprising interconnected parameters and diverse datasets. Addressing this concern, Seenity has pioneered a distinctive risk assessment solution, delineating the components of risk through a nuanced blend of technical and conceptual elements.

At Seenity, we assert that those constructing models must possess control and comprehension of the calculated data. Industry professionals, well-versed in risk rates translating into data, play a pivotal role. In the model’s construction and implementation, underwriters are mandated to acquaint themselves with every data point, discerning its impact and significance in relation to risk. Our solution empowers users to selectively choose the data utilized in the model, facilitating transparency.

Furthermore, our platform allows users to scrutinize the data influencing each prediction, providing a granular understanding of the decision-making process. In the culmination of this process, we meticulously gather, present, and analyze aggregated insights. This holistic approach underscores our commitment to providing a professional, transparent, and comprehensive mechanism for risk assessment.